Use our Position Size and Risk Calculator to easily calculate the recommended lot size, using live market quotes, account equity, risk percentage and stop loss.

What are lots in forex?

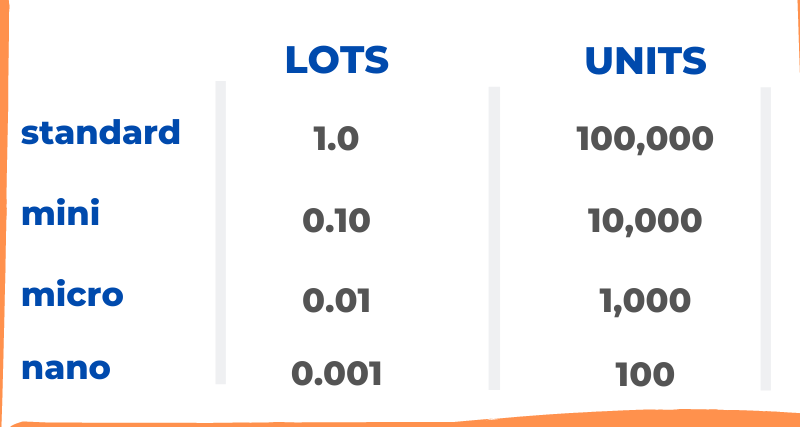

In forex, a "Lot" defines the trade size, or the number of currency units to be bought/sold in a trade. One Standard Lot is 100,000 units of the base currency.

Most brokers also allow trading with fractional lot sizes, down to 0.01, sometimes even less. Fractional lot sizes are categorized as mini lots (0.10), micro lots (0.01) and nano lots (0.001). Please refer to the image above to compare the lots and correspondent currency units.

How to use the Position Size and Risk Calculator

Instrument: Traders can select from major forex pairs, minors and exotics, several cryptocurrencies, such as BTC/USD, ETH/USD, LTCUSD, XLM/USD and XRP/USD, and a range of commodites, such as Gold, Silver and Oil. Let's choose, for our example, the USD/CAD pair.

Deposit currency: The account base currency is important to assess the ideal lot size, as it takes into consideration the pip value and the market rate of the selected cross. We choose USD as our deposit currency, for this example.

Stop-loss (pips): Traders should input the maximum number of pips willing to risk in a trade. For this example we will use 100 pips for our stop-loss.

Account balance: Pretty straight forward, traders just need to input the account equity. For our example, we will type 2000.

Risk: The crucial field of this Position Size and Risk Calculator! In this field traders can select from a risk percentage or any value in the account base currency ($2, $20, $40, etc). As a guideline, professional traders do not risk more than 2% of the account equity per trade. This money management rule allows traders to last longer in their trading careers, and eventually, also to recoup from previously losing trades. So, for our example, we will select 2% risk.

Now, we hit the "Calculate" button.

The results: The Position Size and Risk Calculator uses a market price live feed with the current interbank rate (in a 5-digit format) and it will display the selected currency pair price (in our example the USD/CAD price).

In this case, using a stop-loss of 100 pips and risking 2% of our account equity, the recommended lot size would be 0.05 lot.

Next, the calculator displays the amount of units that the 0.05 lot represent; 5,000 units, and finally the portion of the account equity at risk, or the value of the position, in our case, 40 USD.

You might also find our Drawdown Calculator useful. It can help you to accurately calculate how your trading account equity can be affected after a series of losing trades.